how to short tesla stock on td ameritrade

There are a bunch of possible reasons but a short squeeze is one of the main ones. I just assumed there were too many people wanting to sell at that point and I was too late to the short game.

Trading The Spx Weeklys Dale Brethauer Day Trading Trading Strategies Swing Trading

But you can reach out and find out.

. If you own shares of TSLA before the market. Once youve enabled your account for margin you can enter an order to short sell a stock. SCHW is the owner of TD Ameritrade.

Tesla shares which have plunged 20 in the past month closed 045. Open a TD Ameritrade Account. This is how stocks start to become a problem for some people.

In order to short sell on TD Ameritrade you must have a margin-enabled non-retirement account with at least 2000 in marginable equity. FWIW I tried opening a short around 220 and had the same experience. A dynamic narrative one that serves to justify the detachment of share prices from a companys intrinsic value.

In order to short sell on TDA you need to be approved for margin and have an account value of 2k. No offense but it doesnt really sound like youre that sure of how margin loans and short selling work so Id recommend staying away from it as. Before being acquired by Charles Schwab TD Ameritrade was an American online broker based in Omaha Nebraska that grew rapidly through acquisition to become the 746th-largest US.

What is a stock split. I doubt theyll allow you to trade on margin from their short list with only 4K. Splits are a change in the number of outstanding shares of a companys stock without a change in shareholders ownership percentage in.

Tesla Demonstrates Why Short Selling Is So Much More Dangerous Than Going Long Forced Selling. Then fund your account with at least 2000 which is a requirement for shortmargin trading. Go to my account then shareholder library.

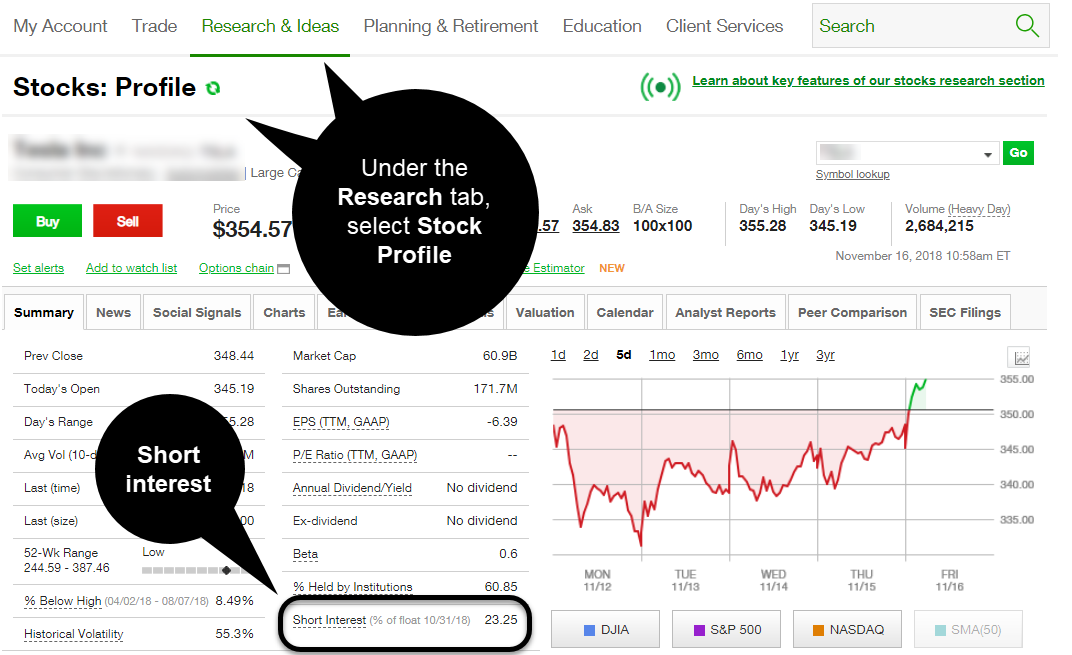

The split takes effect on 31 August for each shareholder of record on 21 Aug. TD Ameritrade displays two types of stock earnings numbers which are calculated differently and may report different values for the same period. You have to specify that youre planning to short this particular stock.

GAAP earnings are the. Services offered include common and preferred stocks futures ETFs option trades. TD Ameritrade does not charge a fee for this type of a stock split.

It is calculated by determining the average standard deviation from the average price of the stock over one month or 21 business days. The goal is to find and invest in quality stocks that are going to provide a return or dividend for the long haul. It will show up 15 mins before meeting starts.

At its peak this month a quarter of the shares of Tesla were being used to short the company which means that more than 13 billion was. Charles Schwab corp NYSE. Historical volatility can be compared with implied volatility to determine if a stocks options are over- or undervalued.

Teslas stock traded higher by 84 at time of publication on Friday to 1512 per share. Account Minimum You must have a minimum of 2000 dollars available to trade with or short within a TD Ameritrade margin account. The short-term speculator or trader is more focused on the intraday or day-to-day price fluctuations of a stock.

Instead it takes short orders and then tries to find the shares to actually short. The Companys automotive segment includes the design development manufacturing sales and leasing of electric vehicles as well as sales of automotive regulatory credits. I thought this to be good info.

You are able to sell short or write a put if your account is approved for the appropriate level of option trading. Are you approves for short selling on TD ameritrade. Open an Account Now.

I have no clue what questions will be asked but still kind of cool. For clients interested in trading non-exchange-traded Over The Counter OTC stocks the industry is currently experiencing unusually high trading volume and third-party market makers currently may be delayed or in certain limited circumstances unable to complete trades in certain OTC stocks. Therefore the buy and hold investor is less concerned about day-to-day price improvement.

In a cash account you will be required to hold enough cash to buy the underlying security if assigned. Ad No Hidden Fees or Minimum Trade Requirements. Some market makers may reject unmarketable sell.

So TD Ameritrade has to go look for shares that traders can borrow before actually selling them short. Shorting a stock is as simple as buying and selling any other publicly traded stock on TD Ameritrades website. Designs develops manufactures sells and leases fully electric vehicles and energy generation and storage systems and offer services related to its products.

The popular money managing firm sold 10035 shares estimated to be worth 88 million in the Musk-led company on Thursday. Designs develops manufactures sells and leases fully electric vehicles and energy generation and storage systems and offer services related to its products. Initially it says open and then it changes to rejected Havent contacted TD about it since Im a lowly retail trader with a small balance.

A case for massive growth as well as a case for financial stress. The equity required to maintain your short position may vary based on the market price of the security you shorted and if the short position moves against you your account could face a margin call requiring you to deposit additional funds. The volatility of a stock over a given time period.

TSLA recently announced a 5-for-1 stock split. There is no method at TD Ameritrade for customers to find out. The typical option contract represents 100 shares of stock so in the example above you have been required to hold 9700 97.

You can vote live thru the TD Ameritrade website. The stock split happens automatically in your account and you are not required to do anything. It works the same as it would on any other platform.

A stock split is a type of corporate action that occurs when a companys board of directors decides to divide the companys outstanding shares into a larger or smaller number of shares. Classic signs of a short squeeze can include. The broker will lend it to youfor a fee of around 5.

Unfortunately TD Ameritrade does not have a short locate service that clients can use either on its website or desktop platform.

How Google Earns Money Earnings Earn Money Money

Pin On Coronavirus 2020 Covid 19

Crypto Currency Bitcoins Crypto Currencies Bitcoin Shirts

Td Ameritrade Restricts Some Trades In Amc Gamestop Others Thestreet

How To Short Stock W Td Ameritrade 3 Min Youtube

The Short And Long Of It Your Top Questions On Short Ticker Tape

Best Stock Market Sectors Heatmap Stock Market Stock Screener Global Stock Market

Shorts In A Twist Tesla Shares Seem To Be Going Through A Classic Squeeze

Pin By Shesoughohqh On Photoshop Editing Business Names Landscaping Business How To Plan

Retail Investor S Counterattack Gme Amc Short Squeeze In 2021 Online Broker Online Trading Investors

3 Penny Stocks To Buy For Under 3 But Are They Worth Watching Penny Stocks To Buy Penny Stocks Best Penny Stocks

How To Short Sell In Tdameritrades Thinkorswim Thinkorswim Tutorial Youtube

We Re In Our 60s My Husband Plans To Work Until He Drops Dead And Our Medical Bills Are In 2022 Preparing For Retirement Take Money Journeys Reading

Best Penny Stocks To Buy Now 3 To Watch Amid Sprt Short Squeeze Penny Stocks To Buy Best Penny Stocks Penny Stocks

Pin By Shesoughohqh On Photoshop Editing Business Names Landscaping Business How To Plan

Short Selling Stocks Td Direct Investing

Td Ameritrade Short Selling Stocks How To Sell Short Fees 2022

Trading The Spx Weeklys Dale Brethauer Day Trading Trading Strategies Swing Trading

Td Ameritrade Short Selling Stocks How To Sell Short Fees 2022